Did you know that every month, within 5 miles of your home, there’s a $15,000 net-profit deal waiting to be had? The hard part is finding it, and then knowing how to creatively structure it into a big-profit deal. There won’t be a large sign in the yard that reads: Stop Here – $15,000 Deal Inside!

Did you know that every month, within 5 miles of your home, there’s a $15,000 net-profit deal waiting to be had? The hard part is finding it, and then knowing how to creatively structure it into a big-profit deal. There won’t be a large sign in the yard that reads: Stop Here – $15,000 Deal Inside!

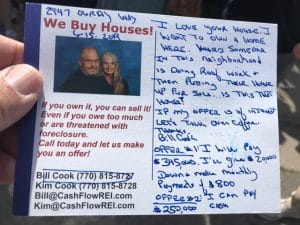

A common mistake made by many would-be real estate investors is to run a We Buy Houses ad, then sit back and wait for the phone to ring. A truth: The phone rarely rings! Because of this, most new investors go out of business long before they find their first deal!

To succeed at real estate investing, you must get face-to-face with sellers on a regular basis. The fastest, cheapest and most effective way to accomplish this all-important task is to simply knock on sellers’ doors and ask why they’re selling.

In addition to door-knocking, you must continually learn creative deal structuring techniques from experienced real estate investors. The best creative deal structurer I know is Pete Fortunato. With over 50 years of deal-making experience under his belt, he’s the master.

To show you how to make the impossible deals not only possible, but also very profitable, let’s look at one that Kim and I completed.

In early October 2010, I was knocking on sellers’ doors in a nice subdivision off Mac Johnson Road in Cartersville, Georgia. I was blanket canvassing, which means I was knocking on every homeowner’s door in that subdivision and asking folks if they knew anyone who might be thinking of selling.

At the third door I knocked, the lady told me that she owned a free-and-clear home about two miles away that she needed to sell. It was a vacant three-bedroom, two-bath, doublewide mobile home on Hamilton Crossing in terrible condition. The seller’s asking price was $15,000, and she wanted to sell so she could pay off $2,250 in overdue bills.

In the fall of 2010, real estate values were at their low point. Finding buyers was hard; finding lenders who would loan to buyers was harder still. The last thing I wanted was a beat-up trailer that needed an expensive rehab.

In my shoes, would you do this deal or walk away? If you’d do this deal, how would you structure it and what’s your exit strategy? If you would walk away, do you realize that you’re walking away from a $25,000 net-profit deal?

I explained to the seller that because of the home’s condition and the tanking real estate market, I wasn’t her buyer. After more discussion, she agreed to sell us the property for $2,250 to get quick cash. Was this a win-win deal? Yes! At closing the seller was able to pay off her overdue bills and get rid of a property she no longer wanted, and Kim and I had the opportunity to increase our monthly cash flow without a big financial risk.

Our exit strategy was simple: Clean out the house and sell it as a fixer-upper while offering owner financing. We bought this property on October 12, 2010 and sold it on December 2, 2010 for $19,300 with the following terms: $1,000 down, 12.79% compounding interest, $375 per month.

Less than a year later, the buyer lost her job and gave the property back. We sold it again on September 11, 2011 for $17,900 with the following terms: $500 down, 12.79% compounding interest, $350 per month.

On December 30, 2014, the property owner sold the property and paid off the $10,800 he still owed us on the mortgage.

Here are the numbers: We invested $2,250 in this deal and got back $27,250, for a net profit of around $25,000. Our yearly return on investment was a whopping 187%!

When Kim and I were new investors, because we didn’t know what we didn’t know, we would have walked right past this incredible deal. To learn how to make impossible deals possible, do what we do: hang out with been-there-and-done-that investors. They know stuff!

By the way, would I have found this deal if I hadn’t been out knocking on homeowners’ doors? Not a chance!

If you want to learn more about creative deal structuring and funding, Pete Fortunato and I will be teaching What Box, the seminar, on September 16 and 17, 2017, in Atlanta, Georgia. We’ll be showing you example after example of impossible deals we structured into moneymakers. Please go to our website for more information.

Do you seek real-world real estate investing information? Go to CashFlowREI.com. It’s packed with free creative deal structuring techniques and strategies. Bill and Kim Cook have been investing in real estate since 1995. Their portfolio consists of single-family rentals, a small mobile home park, plus notes and options. If you have questions, give Bill a call at 770-815-8727.