This is the time of year when lots of kids head back to school. Those who have just graduated from high school, however, have entered the working world with high hopes and great aspirations. They think the world is at their feet and success is all but guaranteed.

This is the time of year when lots of kids head back to school. Those who have just graduated from high school, however, have entered the working world with high hopes and great aspirations. They think the world is at their feet and success is all but guaranteed.

These graduates have been force-fed the belief that they need to get a j-o-b so they can have a nice house (with a mortgage), two cars (with car payments) and a couple of kids playing in the backyard.

Sadly, and I don’t know why this is, after twelve years of education, only a handful understand that creating wealth is the name of the game.

For the record, being rich and being wealthy are two completely different things. If you go to work and make a big paycheck, you are considered rich. On the other hand, if checks regularly arrive in your post office box, no matter where you are or what you are doing, that’s wealth.

Bottom line: When you are wealthy, checks are not dependent upon your labor. Said another way – You are paid for what you know, not for what you do. Again, why isn’t this simple concept, which took me 40 years to learn, taught in school?

I don’t know a single person who wouldn’t love to have $9,000 appear in their mailbox each and every month. However, folks choose to not learn how to use a financial calculator or learn the difference between yield and interest rate.

They also turn their noses up at being a landlord and owning rental property. And forget about mobile homes and Lonnie Deals – even though Lonnie Deals can produce the highest yields in real estate investing!

Recently, I talked with one of contractors, Trey. His son, Tucker, is quarterback for Woodland High School in Cartersville, Georgia. Trey said, “I hope my son doesn’t have to work as hard as I’ve had to work. I want better for him.”

I asked Trey, “Do you think that after Tucker graduates, he would be willing to work his tail off for three years, if after those three years he could earn $9,000/month in mailbox money?” “How could he do that?” Trey asked. “Simple. Lonnie deals,” I answered.

Here is the plan: If Tucker averaged buying one $3,000 mobile home in a mobile home park each month for three years, he’d end up with 36 mobile homes.

He’d buy these homes with seller-financed payments of $100 per month. He’d then sell these homes for $6,000 with wrapped owner-financed payments of $350 per month, giving him a monthly cash flow of $250 per home. After three years and with 36 homes, Tucker would be 21 years old, receiving $9,000 per month in mailbox money (36 x $250) and spending his time being a chick magnet.

Frustratingly, instead of being taught this fantastic wealth-building concept, kids are given problems such as: If a train leaves from Atlanta heading north at 53 miles per hour, when will it arrive in Charlotte? Answer: Ask the damn conductor!

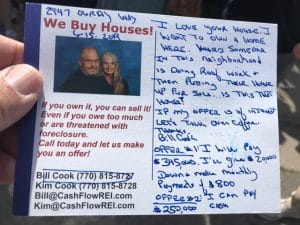

Do you seek real-world real estate investing information? Check out the other articles and videos on CashFlowREI.com. They are packed with free creative deal structuring techniques and strategies. Bill and Kim Cook have been investing in real estate since 1995. Their portfolio consists of single-family rentals, a small mobile home park, plus notes and options. If you have questions, give Bill a call at 770-815-8727.